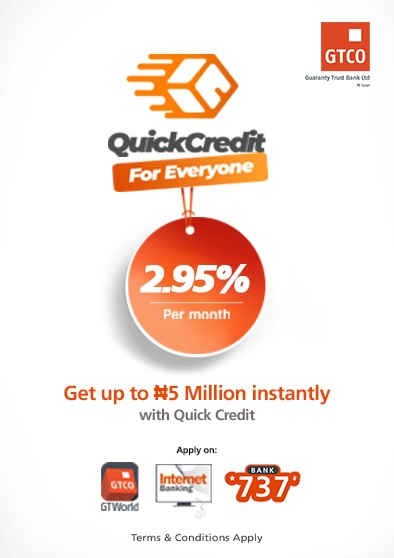

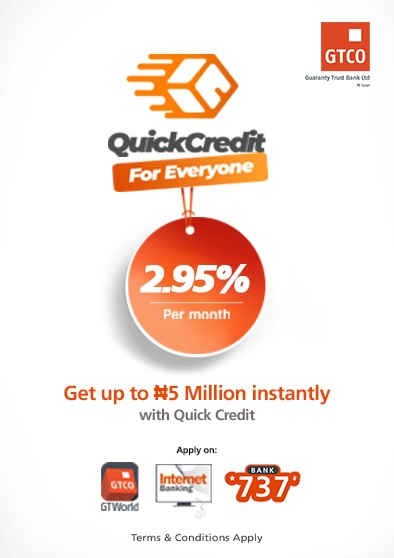

QuickCredit for Small Business

You shouldn't have to run around, to run your business

This is a time loan product aimed at financing the working capital (i.e funds needed for day to day needs) of SMEs in the Education (creche, primary & secondary schools) and Healthcare (Hospitals, Retail Pharmacies and Diagnostic Centres).

Click here to Apply